RHI Magnesita’s purpose is to master heat, enabling global industries to fuel modern life. The company’s advanced products are essential for its customers in the steel, cement, metals, glass, energy and chemicals industries. Through the reliable supply of innovative refractory products and services, RHI Magnesita enables its customers to sustainably deliver the basic materials that are essential for modern life.

We aim to be our customers’ partner of choice on their own decarbonisation journeys!

RHI Magnesita strives to be the sustainability leader in its sector. The company’s sustainability strategy is based on the 10 Principles of the UN Global Compact covering human rights, labour, environment, and anti-corruption.

RHI Magnesita has a dedicated Corporate Sustainability Committee that monitors performance related to climate change, environment, health and safety, stakeholder relations, and other ESG risks. Executive and functional leaders are accountable for delivering sustainability priorities, and the Global Sustainability Team is responsible for external reporting, assessing sustainability-related risks, and liaising with the Board and key internal and external stakeholders. They also provide regular updates to the Corporate Sustainability Committee. A collaborative approach ensures co-ordination with key functional areas such as Health & Safety, environment, sustainable technology and decarbonisation, recycling, finance, risk management and compliance, and procurement. This governance framework facilitates a comprehensive and integrated

approach to sustainability.

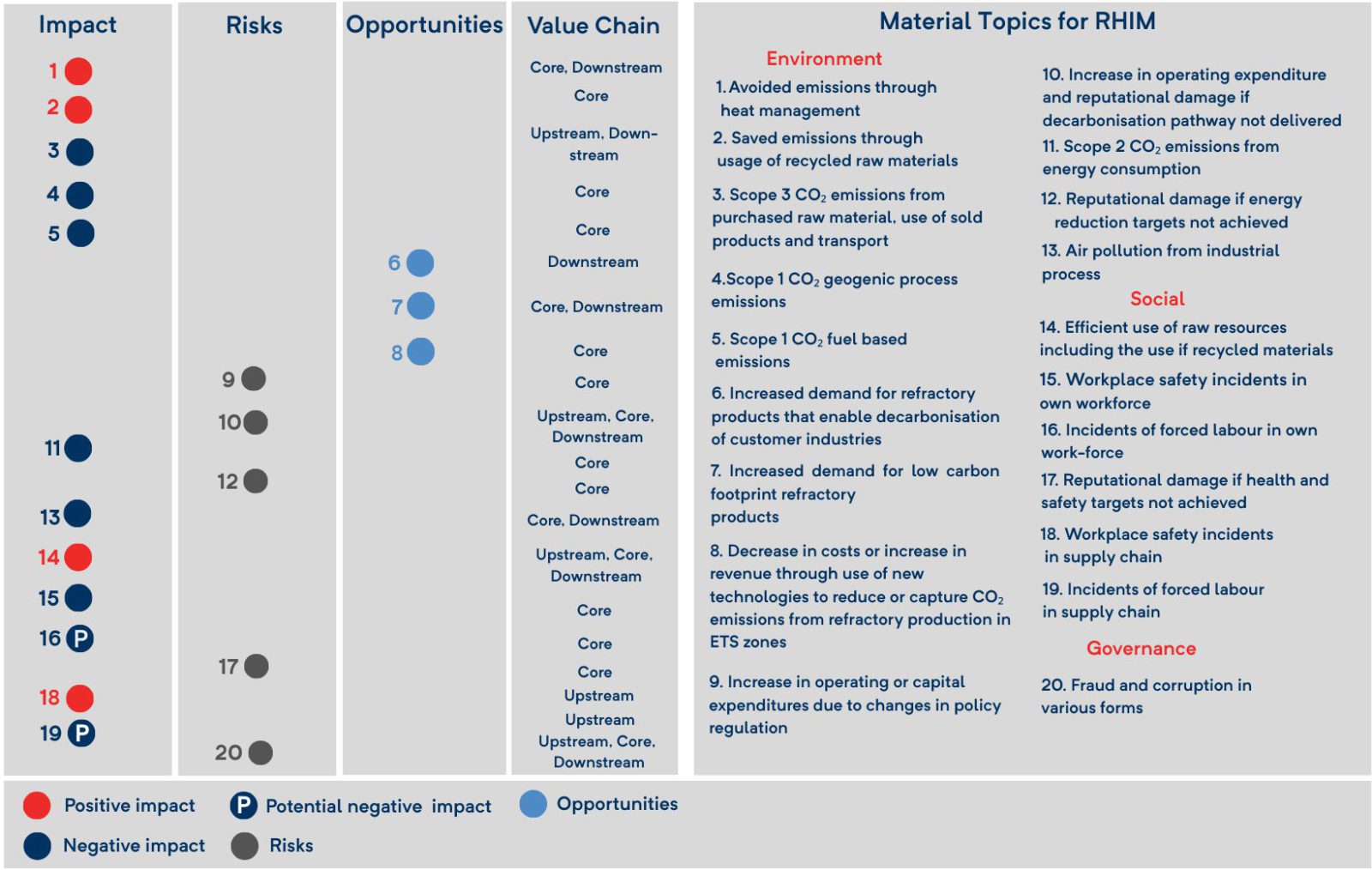

At the core of RHI Magnesita’s Consolidated Sustainability Statement lies the principle of double materiality, addressing both the company’s environmental and social impacts (“inside-out”) and the influence of sustainability factors on its financial performance (“outside-in”). Guided by the European Sustainability Reporting Standards (ESRS), RHI Magnesita conducted a comprehensive materiality assessment across its value chain, identifying key risks, opportunities, and impacts through a robust, data-driven methodology. This process integrates quantitative and qualitative insights, stakeholder input, and strategic alignment to determine which sustainability matters are most significant—whether by impact, financial relevance, or both. The outcome informs our sustainability reporting, ensuring transparency and accountability while supporting long-term value creation.

Although water and biodiversity are not considered material topics for RHI Magnesita, the following fact sheets provide further insight into the rationale behind this assessment:

For impact materiality, 92 matters were assessed. Of these, 12 were classified above the materiality threshold. For financial materiality, 60

matters were assessed. Of these, eight were classified above the materiality threshold and one was added as a result of the stakeholder

validation process.

A regular review of the scope of the DMA is expected, to remain responsive to the evolving regulatory environment and/or the Group goes through significant changes in its industrial footprint (e.g. M&A).

RHI Magnesita’s executive management and the Board considered and set sustainability targets in 2019 to be achieved by 2025, against a 2018 baseline. During 2024 the Group worked to establish new targets for 2030, against a 2024 baseline.

RHI Magnesita actively supports the UN Sustainable Development Goals (SDGs).