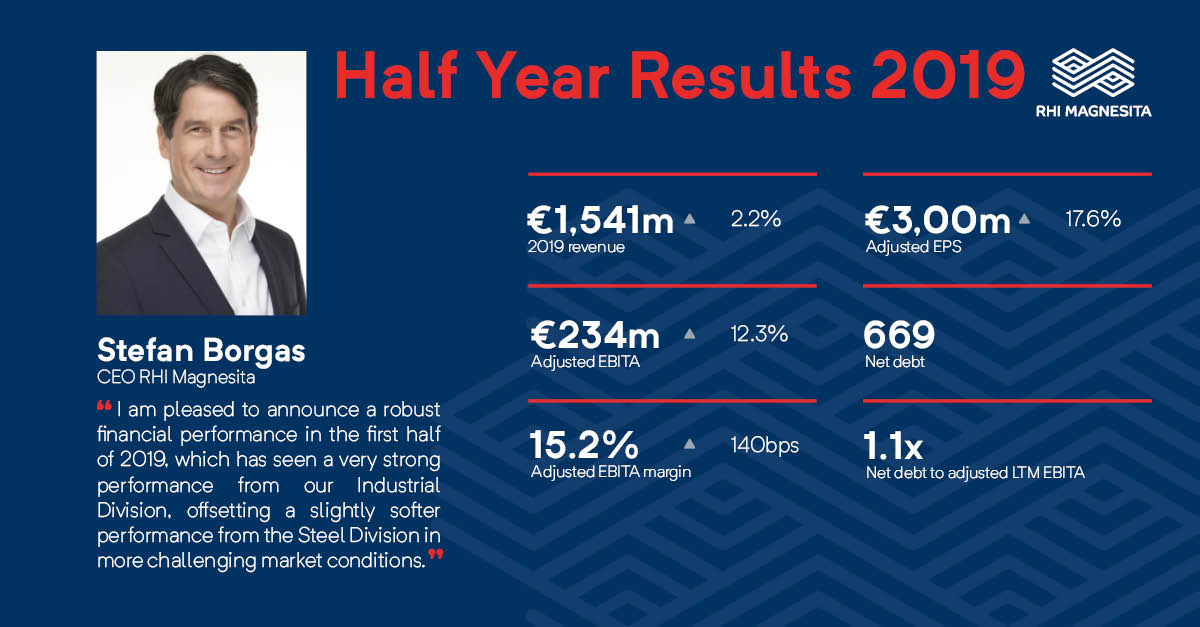

(Vienna/London) RHI Magnesita, the leading global supplier of refractory products, systems and services, today announces its results for the six months ended June 30, 2019. “I am pleased to announce a robust financial performance in the first half of 2019,” says Stefan Borgas, CEO RHI Magnesita. “Despite difficult end markets, we have seen a very strong performance from our Industrial Division, offsetting a slightly softer performance from the Steel Division in more challenging market conditions.”

Financial Highlights

Outlook

In the second half of 2019, RHI Magnesita expects the current market uncertainty to continue, which with poor visibility, there is the possibility of reduced customer inventories. “However, the self-help measures at our disposal, the initial benefits of the price rise program announced in April and the momentum in our Industrial Division underpin our confidence in further progress. Consequently, management expectations for the full year operating results remain unchanged,” says Borgas.

Read the full RNS here.

About RHI Magnesita

RHI Magnesita is the leading global supplier of high-grade refractory products, systems and solutions which are indispensable for industrial high-temperature processes exceeding 1,200°C in a wide range of industries, including steel, cement, non-ferrous metals and glass. With a vertically integrated value chain, from raw materials to refractory products and full performance-based solutions, RHI Magnesita serves customers in nearly all countries around the world. The Company has a high level of geographic diversification with more than 14,000 employees in 35 main production sites and more than 70 sales offices around the world. RHI Magnesita intends to leverage its global leadership in terms of revenue, scale, product portfolio and diversified geographic presence to target strategically those countries and regions benefitting from more dynamic economic growth prospects.

Its shares have a premium listing on the London Stock Exchange (symbol: RHIM) and are a constituent of the FTSE 250 index. For more information please visit: www.rhimagnesita.com

Media Inquiries

Lisa Fuchs

Corporate Spokesperson

lisa.fuchs@rhimagnesita.com

M +43 699 1870 6198

Patrizia Pappacena

Media Relations Manager

patrizia.pappacena@rhimagnesita.com

M +43 699 1870 6443